Accruals and Prepayments Journal Entries

ACCRUED EXPENSES Accrued expenses Journal Entries. Accrual Journal Entry Example will sometimes glitch and take you a long time to try different solutions.

Understand How To Enter Accruals Prepayments Transactions Using The Double Entry System Youtube

LoginAsk is here to help you access Accrual Journal Entry Example quickly and.

. Prepayments A prepayment is when you pay an invoice or make a payment for more than one period in advance but want to show this as a monthly expense on your profit and loss. LoginAsk is here to help you access Journal Entries For Accruals quickly and handle. How to explain accruals and prepayments.

The perks of such expenses are yet to be. What is the journal entry for an accrual. How to do accruals and prepayments.

Accruals and Prepayments Journal Entries The basic principle behind accrual accounting is to record revenues and expenses regardless of payment. Journal Entries For Accruals will sometimes glitch and take you a long time to try different solutions. In this case we need to make the journal entry for customer prepayment by recognizing the amount received as a liability that we owe to the customer.

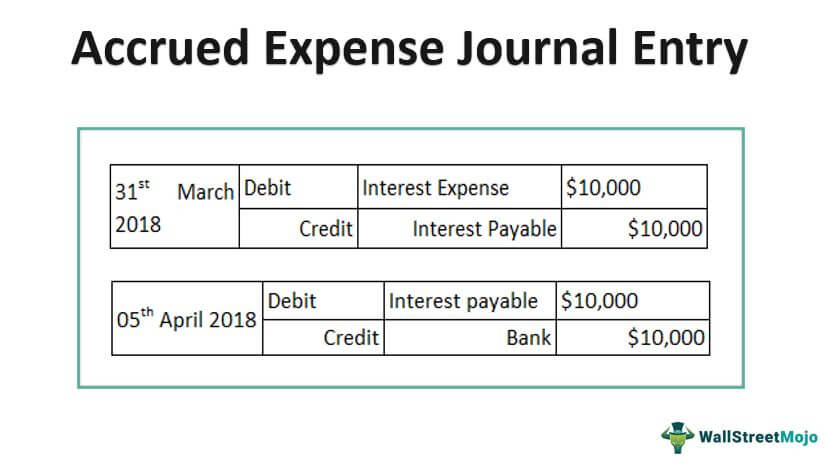

Reversing entries are made because previous year accruals and prepayments will be paid off or used during the new year and no longer need to be recorded as liabilities and. For the buyer the opposite happens. An accrued expense refers to when a company makes purchases on credit and enters liabilities in its general ledger acknowledging its obligations to its creditors.

Common Reasons for Prepaid Expenses The two most common. As with all double entry bookkeeping. Debit Credit are expenses a To record the Expenses Bank incurred but unpaid.

Solution to recording accrued expenditure Solution The total expense charged to the income statement in respect of insurance should be. During the journal entries in the accounting book of the buyer the prepayment account is debited with the payment whereas the cash account is. In this case we need to make the journal entry for prepayment received as a liability that we owe to the customer from the time of receiving the cash.

Accruals and Prepayments Journal Entries Pe_SierraJones459 September 09 2022. The prepaid income will be recognized as income in the next accounting period to which the rental income relates. With amortization the prepayment will be gradually zero following the.

Under the accrual basis of. Understand how to enter AccrualsPrepayments of Revenue and Expenses into T accounts using the double entry system. By watching this video you will be show.

Accruals and prepayments give rise to current liabilities and current assets respectively in accordance with the matching principle and accrual accounting. Reversing entries are made because previous year accruals and prepayments will be paid off or used during the new year and no longer need to be recorded as liabilities and assets. Show the relevant entries in the ledger accounts.

Chapter 6 Accruals And Prepayments Accruals And Prepayments Level 3 Study Tips Aat. Prepaid Rent Income Liability 10000. Expenses paid cash A liability-expense b.

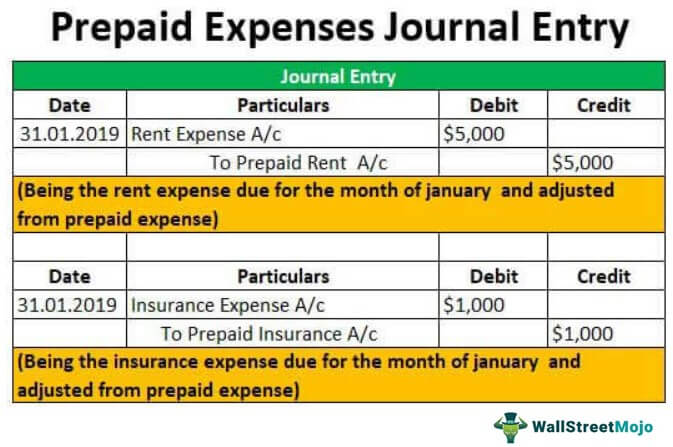

The second step is all about amortizing the prepaid expense account for the consumption over time. Under the accrual basis of accounting. Journal Entry for Prepaid Expenses Prepaid expenses are those expenses which are paid in advance for a benefit yet to be received.

Ca Accounting Books Accruals And Prepayments Introduced Accrual Accounting Books Accounting

Prepaid Expenses Journal Entry How To Record Prepaids

Accrued Expense Journal Entry Examples How To Record

Ca Accounting Books Approachs For Accrued Expenses Accounting Books Accrual Accounting Accounting

0 Response to "Accruals and Prepayments Journal Entries"

Post a Comment